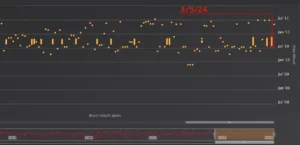

Four days later, on March 5—the day bitcoin reached its peak value of $69,210 per coin—the same entity transferred another 1,000 vintage bitcoins from 2010. On March 1, 2024, an infamous and massive bitcoin mega whale moved 2,000 vintage bitcoins from 2010.

Millions are Moved by the 2010 Bitcoin Whale as Prices Peak

Known for large-scale bitcoin transactions since being discovered by Bitcoin.com News in March 2020, this well-known whale has carried out yet another round of transfers totaling 1,000 BTC, or around $63.29 million based on current exchange rates. These coins are the result of block rewards that were initially mined in August, September, October, and November of 2010, when the value of a bitcoin was at or below $0.39.

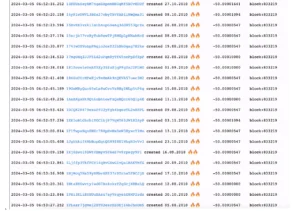

Twenty block rewards from 2010 were moved in total, and block 833,219 contains all associated transactions. The sequence of 20 transactions that were completed on Tuesday further highlights the whale’s historical pattern, which is mirrored in the current activity. Pay-to-Public-Key-Hash (P2PKH) addresses were used by all 20 of the older wallets from 2010, and the money was combined into a single Pay-to-Script-Hash (P2SH) address that was designated as “36i1W.” The 1,000 BTC has been moved from the original P2SH consolidation address as of this report.

BTCparser.com was able to capture 20 BTC block rewards on March 5, 2024.

Tuesday’s maneuver was once again discovered by btcparser.com, a blockchain research program that monitors hundreds of addresses from 2009 to 2017 that are thought to be “sleeping bitcoin.” Additionally relocated was the matching bitcoin currency (BCH) linked to the 2010 Coinbase 20 BTC incentives. This is the 16th time that the behavior of this specific whale has been observed. Up until now, the mysterious entity from 2010 has moved an astounding 17,000 BTC from dormant addresses. This whale frequently chooses critical times to move, usually around important price turning points and other important events in the history of bitcoin, like its third anniversary on January 3, 2021.

Theholyroger.com brought attention to the 2,000 BTC transaction visually. This specific whale’s activities have been reported by Bitcoin.com News on fifteen separate occasions beginning in 2020. Sightings have been reported on the following dates: March 11, 2020; October 11, 2020; November 7, 2020; November 8, 2020; December 27, 2020; January 3, 2021; January 10, 2021; January 25, 2021; February 28, 2021; March 23, 2021; June 9, 2021; November 10, 2021; November 12, 2021; December 4, 2023; March 1, 2024; and most recently, March 5, 2024.

On March 11, 2020, the whale made its first appearance. During that day, the price of bitcoin fluctuated between $7,953 and slightly less than $4,000. After the activity in March 2020, the whale went into dormancy until October. It then started moving again each month through March 2021, with two further trips in November 2020 and three in January 2021. Following a short break, the whale reappeared on June 9, 2021, and then twice again in November 2021, the first of which coincided with the top price of Bitcoin for that year.

The whale disappeared until the end of 2023. It reappeared on December 4 and then earlier this week on March 1, which happened to coincide with Bitcoin hitting its maximum price of $69,210 per coin once more. The curious movements of this bitcoin mega whale reflect a mysterious but exciting part of the cryptocurrency world, where big transactions by unidentified parties can shape market sentiments and emphasize the persistent appeal of the first coins to be mined.

Such endeavors not only contemplate the legendary origins of bitcoin but also arouse conjecture over its forthcoming influence and the identity of the whale responsible for these enormous transactions. This whale seems to have been paying out 2010 block rewards in sequences with the same pattern even before Bitcoin.com News made its first observations in 2020.

What are your thoughts on the 2010 mining entity that used 1,000 bitcoins in a single string to spend 20 block rewards? Please share your thoughts on this topic in the space provided for comments below.