Recently, Shiba Inu has been the epicenter of booming activity; in only one day, an astounding 3.7 trillion SHIB tokens were transferred in a variety of transactions. A narrative rife with conjecture regarding the ramifications of those substantial transfers and their possible impact on the performance of the meme coin has been ignited by this frenzy.

Big trades frequently show that large players are shifting their positions, which may be a harbinger of upcoming market movements like price pumps or sell-offs that could affect the token’s value.

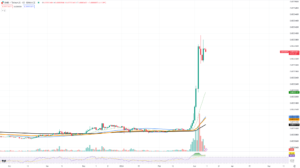

Chart SHIB/USDT by TradingView

Transfers, for example, from an exchange to a hot wallet may indicate that a long-term holding strategy is being employed by the investor, who is shifting SHIB to a more secure storage alternative. On the other hand, a move to an exchange can imply a desire to buy or sell, indicating more market liquidity.

SHIB’s price chart tells a tale of increased volatility and speculative interest from a technical analysis standpoint. The $0.000020 zone, which has historically served as a launching pad for rallies, is a strong local support level that SHIB is trading near according to the TradingView chart. At $0.000035, resistance is looming overhead and this is where prior rallies have petered out.

SHIB is still trading within a well-known range despite the recent spike in transactions not translating into a notable change in price. But given the volume of tokens trading hands, and the token’s history of abrupt and volatile price swings, it is impossible to rule out the potential of a reversal. If the support level breaks, SHIB might be considering a test of lower levels, which might force away unskilled players and pave the way for a new round of price discovery.