Four fintech companies have been instructed by the Central Bank of Nigeria to stop opening new accounts, citing the possibility that bitcoin dealers may utilize them. A representative of an impacted fintech company has linked the Central Bank’s instruction to an ongoing assessment of the Know Your Customer (KYC) protocols these companies have put in place.

Fintech Companies Say Freeze Is Only Temporary

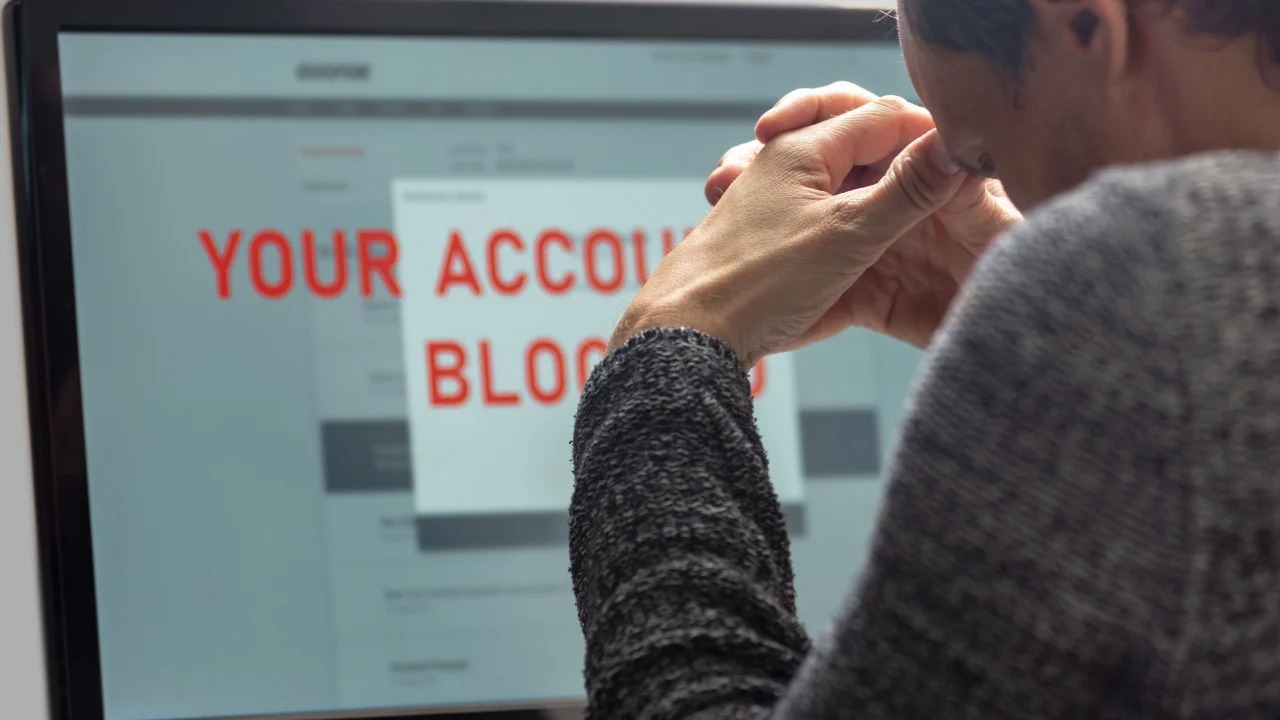

Four fintech companies have reportedly received orders from the Central Bank of Nigeria (CBN) to stop opening new accounts in an effort to keep out cryptocurrency traders who are allegedly aggravating the currency’s collapse. Kuda, Opay, Palmpay, and Moniepoint are all impacted by the directive.

According to a Techcabal report, the Central Bank of Nigeria (CBN) issued its decision soon after the Nigerian anti-graft agency, the Economic and Financial Crimes Commission (EFCC), banned more than 1,140 bank accounts that were purportedly linked to illicit overseas transactions. A remark from one of the fintech companies that suggests the account freezing is just temporary is also cited in the story.

Similar to this, a fintech company official who chose to remain nameless stated that the suspension was only brief. The executive also connected the CBN’s mandate to a continuous examination of the impacted fintech companies’ Know Your Customer (KYC) procedures.

Fintech Companies Aren’t Improving Their Standing With the CBN

Meanwhile, according to a second anonymous source cited in the story, the CBN and Nigeria’s National Security Agency had already commissioned the four companies before giving the mandate.

The CBN believes that many cryptocurrency traders were trying to upset the FX market by using fintech platforms. According to the anonymous source, banks enjoy a better relationship with regulators, whereas fintechs have not yet established a similar rapport or improved their standing with the CBN.

The Central Bank of Nigeria (CBN) seemed to reject a guideline it had given on February 6, 2021, when it joined the Nigerian government in attributing the depreciation of the local currency to cryptocurrency dealers. Since then, Binance has been under fire from Nigerian officials for allegedly taking more than $26 billion out of the country’s economy.

But, since the naira continues to weaken against other major currencies, Nigerian authorities are also focusing on financial technology companies as well as other cryptocurrency exchanges. However, a recent investigation conducted by the Economic and Financial Crimes Commission (EFCC) found that commercial banks were responsible for 90% of the blocked accounts, while financial technology companies were for just 10% of them.