According to onchain monitoring company Glassnode, a significant change has taken place in the wake of the market’s recovery from the FTX collapse, placing bitcoin in a high-risk regime. In its most recent analysis, the business states that this regime usually denotes a turning point that frequently occurs before bull markets start, at which point long-term investors start to witness a return to profitability.

Bitcoin Enters a High-Risk Zone: An Indicator of Future Bull Markets

Using onchain data, the most recent Risk Assessment Framework study presents a sophisticated method for comprehending the market cycles of bitcoin (BTC). The approach provides a data-driven model to assess drawdown risks by examining both short- and long-term risk cycles. The paper outlines the transition into a high-risk regime, which is a crucial point often seen at the start of bull markets.

For long-term investors, this phase is marked by higher profitability, which reflects a growing confidence in the market’s future direction. Accordingly, “‘High-Risk’ is defined as a point where the market is probably in a speculative bubble,” according to Glassnode’s research. “Low-risk” situations, on the other hand, are thought to be those in which the majority of the speculative excess has been cleared and where the market is more likely to be in a bottom formation pattern.”

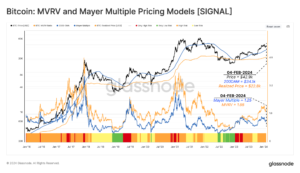

Metrics like the Mayer Multiple and MVRV Model, which together outline the market’s present risk position, form the basis of Glassnode’s analysis. These indicators show how the price of bitcoin deviates from its long-term averages, offering a systematic approach to spot bottom formations and speculative bubbles.

The recent move of these indicators into the high-risk area, according to Glassnode researcher Cryptovizart, highlights how speculative the current market conditions are, but historically, this has coincided with the initial phases of market recoveries. Furthermore, the research highlights the significance of investor behavior, specifically as it relates to the Net Unrealized Profit/Loss and Percent of Supply in Profit indicators.

These indicators shed light on market participants’ general feelings of fear or greed as well as the possibility of heightened selling pressure. The market’s current posture in the high-risk domain indicates a cautious optimism, as a large share of coins acquired at lower price points during the last consolidation period are held by the market.

Glassnode further detects changes in market dynamics that come before significant price adjustments by evaluating spending patterns and block space requirements. At present, the high-risk indicators indicate a speculative climate supported by renewed market activity and long-term investor profitability, but also highly volatile. The research highlights the innate optimism among long-term investors, indicating a calculated time for market participation, even though caution is still crucial.

The conclusion of Glassnode’s research states, “These risk factors take into account a broad range of data and investor behavior categories, helping to establish a framework for analysts and investors.” “Even though each indicator can be used separately, using them together frequently gives a more complete picture of the state of the market.”

Regarding the report by Glassnode on bitcoin entering the high-risk regime, what are your thoughts? Please share your thoughts with us in the comments area.