The Bitcoin network’s halving event is less than 10,000 blocks away from happening, according on the most recent data. According to more research, the halves is expected to occur between April 19 and April 21, 2024. Following the halving, block rewards will drop from the current rate of 6.25 bitcoins per block to 3.125 bitcoins per block. “Fundamental onchain activity and positive market structure updates make this halving different on a fundamental level,” according to a recent Grayscale research investigation.

There are less than 10,000 blocks left before the fourth bitcoin halving.

Less than 10,000 blocks need to be mined until the Bitcoin halving event takes place, and the clock is getting shorter every day. Different halve counters that may be found online show somewhat different times, but they are all close to the expected time for the halving event. Finding the number of blocks left till the epoch is the most reliable way to estimate when the halving will occur. The number of blocks left to mine is multiplied by the ten-minute period for each block to achieve this.

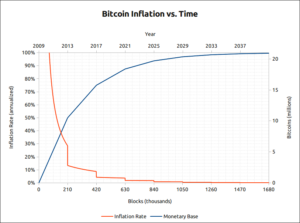

Half of all bitcoins will be halved after 210,000 blocks are mined, which takes four years on average. At the moment, about 900 new Bitcoin are created every day; after the halving, this amount will drop to 450 new Bitcoin every day. Then, in addition to transaction fees from the blocks they process, miners will receive 3.125 bitcoins for each block they mine. Despite suffering a 50% drop in their block reward income, miners are seeing the positive side of things given the strengthening value of bitcoin relative to the US dollar and increasing transaction fees.

Prior to the 2024 Bitcoin Halving, Grayscale Analysis Shows a Fundamental Shift

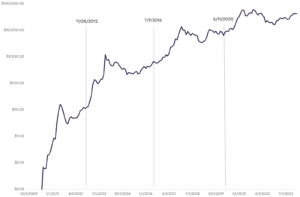

Grayscale’s Michael Zhao examines the extraordinary effects of the 2024 Bitcoin halving on the market in a research released on February 9, 2024. Despite immediate difficulties for miners, Zhao’s research highlights how profoundly different the 2024 halving will be. In ways not seen in prior halvings, it is anticipated that blockchain innovations like ordinal inscriptions and beneficial market structure modifications would maintain and even increase the value of the cryptocurrency asset.

According to Michael Zhao of Grayscale, “the noteworthy excitement and anticipation surrounding Bitcoin halvings stems from their historical association with bitcoin price increases, beyond the obvious supply impact.” As of this writing, there are 9,854 blocks left to mine before block height 830,146 is halved.

By diversifying their financial plans, miners can prepare for lower block rewards, as the report goes on to describe. The goal of this preparedness is to lessen the financial impact by selling reserves and obtaining money through the issue of debt and equity. According to Zhao, the stability and security of the Bitcoin network after the halving depend on this smart placement.

Although the situation may appear grim, there is evidence that miners have been planning for the financial fallout from the halving for some time, according to Grayscale’s study paper. “Miners sold off their Bitcoin holdings onchain in a noticeable trend in Q4 2023, presumably to build liquidity ahead of the block rewards reduction.”

The research also explores how the recently launched spot bitcoin exchange-traded funds (ETFs) have a big impact on absorbing sell pressure and maybe shifting the dynamics of the market in favor of stable BTC prices. In contrast to the expected sell pressure from freshly produced bitcoins entering the market, Zhao explains how the adoption of spot bitcoin ETFs adds a new, consistent source of demand.

“Bitcoin is not just surviving; it’s evolving as we approach the 2024 halving,” Zhao says, pointing out how the market structure of BTC has changed since spot Bitcoin ETFs were approved in the US. As a result, the impending halving will be a historic occasion with enduring effects on the value of Bitcoin and its place in the larger financial system. This progression points to a maturing market that may change investors’ attitudes toward cryptocurrencies.

Regarding the impending Bitcoin network halving event, what are your thoughts? Please feel free to discuss this topic in the comments area below.