As the price of bitcoin surged on Monday, nine freshly created spot exchange-traded funds (ETFs) for the cryptocurrency smashed their all-time daily volume record. A Bloomberg ETF analyst stated, “It’s official…the new nine bitcoin ETFs have broken all-time volume record today with $2.4b,” adding that Blackrock’s Ishares Bitcoin Trust (IBIT) “went wild,” shattering its record by roughly 30%.

Notice the Record-Breaking Bitcoin ETFs

Exchange-traded funds (ETFs) that track spot bitcoin saw a record $2.4 billion in trading activity on Monday due to a spike in interest. A large amount of this activity was driven by Blackrock’s Ishares Bitcoin Trust (IBIT), which accounted for $1.3 billion of the entire volume. Eric Balchunas, a Bloomberg ETF analyst, described on social media platform X:

It’s official: with $2.4 billion in volume today, the nine new bitcoin ETFs have shattered the all-time record, just surpassing Day One but more than doubling their recent daily average. IBIT broke its record by nearly 30%, accounting for $1.3 billion of it.

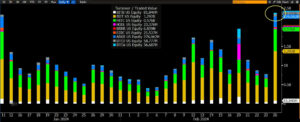

9 spot trading volumes for bitcoin ETFs. Eric Balchunas, a Bloomberg analyst, is the source.

9 spot trading volumes for bitcoin ETFs. Eric Balchunas, a Bloomberg analyst, is the source.

Bitwise Bitcoin ETF (BITB), Invesco Galaxy Bitcoin ETF (BTCO), Vaneck Bitcoin Trust ETF (HODL), Franklin Bitcoin ETF (EZBC), Valkyrie Bitcoin ETF (BRRR), Ark 21shares Bitcoin ETF (ARKB), Fidelity Wise Origin Bitcoin Fund (FBTC), and Blackrock’s Ishares Bitcoin Trust (IBIT) are the nine bitcoin exchange-traded funds (ETFs). After being approved the day before by the U.S. Securities and Exchange Commission (SEC), they started trading on January 11.

On January 11, trading started for the bitcoin ETF (GBTC) offered by Grayscale Investments, which was formerly known as the Grayscale Bitcoin Trust. Nevertheless, since the fund’s inception, there have been significant withdrawals. Another Bloomberg analyst, James Seyffart, stated that “the entire bitcoin ETF category had its 2nd most traded day ever at $3.2 billion” when taking into account GBTC data. “Only the launch day, when they exchanged $4.6 billion, was larger,” he continued. “As Eric pointed out, this is a record volume number for the Newborn Nine without GBTC.”

According to Bitmex Research, the 10 spot bitcoin ETFs—which include GBTC—saw a total net inflow of $6.03 billion between January 11 and February 26. With a $655.2 million inflow on opening day, it was followed by a $631.2 million inflow on February 13.

On Monday, the price of bitcoin surged in tandem with record spot ETF volume. The price of Bitcoin surpassed $54,000 for the first time since 2021. After that, the price of cryptocurrencies dropped to $57,000, wiping away $70 million in short bets in less than an hour. As of this writing, the price of bitcoin is $56,835.

Regarding nine spot bitcoin ETFs shattering their record daily volume, what are your thoughts? Tell us in the space provided for comments below.