Over the past month, Bitcoin’s value has increased remarkably, and at the beginning of this week, it crossed the $57,000 mark for the first time since November 2021. The surge in value of bitcoin has prompted the creation of derivatives based on the cryptocurrency, leading to an unprecedented level of open interest in bitcoin futures that has surpassed previous milestones established in 2017 and 2021.

Record-Shattering Activity in Bitcoin Futures Drives Open Interest Above $24 Billion

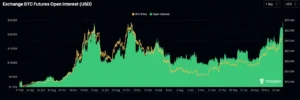

Since mid-October 2023, there has been a noticeable increase in open interest and overall volume in bitcoin derivatives. The total amount of outstanding derivative contracts, like futures, that are still in effect is known as open interest (OI) in the derivatives markets.

It basically acts as a gauge for the amount of money coming into the bitcoin futures market. As of February 27, 2024, the open interest figures for bitcoin futures have risen to an all-time high (ATH) of $24.44 billion.

Interest in bitcoin futures opens on February 27, 2024.

With $23.06 billion reported on the 9th, the most recent ATH exceeded the OI recorded the day before Bitcoin topped $69K per unit in November 2021. The record on February 27 also surpassed the OI on April 13, 2021, which, at $24.27 billion, fell short of the record by just $170 million from Tuesday’s peak.

Measuring bitcoin futures OI can provide trader sentiment, just like other market indicators. An increasing OI is usually associated with a bullish trend, whereas a decreasing OI is associated with a negative trend.

With 137,550 BTC, or $7.77 billion, CME Group leads the bitcoin derivatives market in terms of futures open interest (OI) and has a substantial 31.79% of the market share as of Tuesday. With 108,280 BTC, or $6.13 billion in OI, Binance comes in second position, closely followed by Bybit in third place with $4.10 billion.

Okx is another big player in the market, with $2.47 billion in open interest in bitcoin futures. Other well-known exchanges with respect to open interest in BTC futures are Deribit, Bingx, and Bitget. Apart from the noteworthy performance of bitcoin futures, there has also been a notable increase in the OI of bitcoin options.

The current value has already eclipsed the highs of April and November 2021, even though it hasn’t yet topped the BTC options OI recorded in December 2023. At 7:59 a.m. Eastern Time on Tuesday, February 27, the price of bitcoin on spot markets peaked at $57,315 on Bitstamp.

What are your thoughts on the open interest in bitcoin futures shooting up to record highs? Please feel free to discuss this topic in the comments area below.