According to the most recent Bybit user asset allocation study, between July 2023 and January 2024, institutional digital asset portfolios’ concentration of bitcoin and ethereum rose from 50% to 80%. In contrast to regular investors, institutions seemed to be more optimistic about ethereum than bitcoin throughout this time.

Five Percent of Institutional Digital Asset Portfolios Are Made Up of Stablecoins and Altcoins

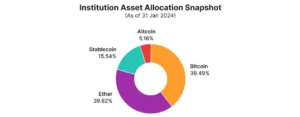

The most recent user asset allocation data from digital asset exchange Bybit shows that, in institutions’ digital asset portfolios, the proportion of bitcoin (BTC) and ether (ETH) increased from 50% to 80% between July 2023 and January 2024. According to the data, each of these cryptocurrencies makes up half of the most recent allocation amount; the remaining 20% is made up of stablecoins and altcoins, which make up 15% and 5% of the total, respectively.

Although the growing proportion of ETH and BTC in institutional portfolios may indicate a bullish view of these popular cryptocurrencies, the crypto exchange platform’s 2024 research indicates that ether is moving ahead of bitcoin.

“Entities are placing significant bets on ether. Beginning in September 2023, the trend picks up speed in January 2024, reaching almost 40%. As of January 31, 2024, ether is the single greatest holding held by INS [institutions]. In light of ether’s relative underperformance in 2023, institutions’ expectations of the favorable effects of the Dencun upgrade on Ethereum may be the cause of the over-allocation to ether, the paper found.

Report from Bybit, the source.

The research also notes that one reason for the institutions’ increasing interest in the cryptocurrency asset is the potential approval of spot Ethereum exchange-traded funds (ETFs). However, the report’s assertions seem supported by these institutions’ decrease in bitcoin allocation, which apparently started in early December 2023, as well as their rise in ETH holdings.

Bybit report as a source

Institutions Almost Completely Give Up All Bets on AI and Memes

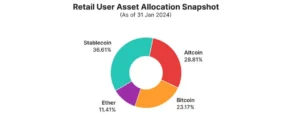

As of January 31, 2024, the average concentration of retail investors in BTC and ETH was just 35%, compared to that of their institutional counterparts. The study claims that this kind of focus is consistent with the “distinct investment style” of ordinary investors, who seem to give altcoins and cash or stablecoins priority.

According to the report, retail investors are still more optimistic about bitcoin than ethereum despite having a lower average BTC and ETH concentration.

Regarding the capital that institutions allocated to BRC-20, AI, and meme tokens, data from the Bybit analysis shows that these institutions had “almost entirely exited positions in these highly volatile token categories.”

How do you feel about this story? Please share your thoughts in the space provided for comments below.