Bitcoin miners found 4,446 blocks in February, earning $1.39 billion in total—$71 million of which came from onchain transaction fees. Bitcoin mining generated $40 million more in revenue in February than it did in January, despite a decline in fees this month.

The Hash Price of Bitcoin Exceeds $100.

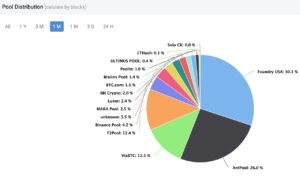

Foundry USA took the lead in February, mining 1,334 blocks (30.06% of the total), followed by Antpool with 1,152 blocks (24.96%). Between 47 and 53 mining pools participated during the month, adding SHA256 hashrate to the Bitcoin chain. Miners made a substantial profit in February, taking in $1.39 billion, which is $40 million more than they did in January thanks to the 47% increase in Bitcoin values in just 30 days.

Distribution of bitcoin mining pools within the last 30 days.

Only $71 million of the $1.39 billion came from on-chain transaction fees, a dramatic decrease from the $133 million in January and much less than the $337 million in fees in December. The value of one petahash per second (PH/s) of hashing power per day, or the hash price of the network, has risen above $100 since February 25, 2024.

The hash price per petahash as of March 2, 2024, is $104, a significant rise from the sub-$85 values observed before to February 25. The network’s hashrate is now operating at 584 exahash per second (EH/s), a little less than the peak of 609 EH/s that was recorded on February 7, 2024. The mining landscape is still dynamic and under close observation, with 1,796 blocks left until the next difficulty adjustment, which is predicted to decrease by 2.9%, and 7,172 blocks until the subsidy halving, which is estimated to occur between April 15 and 16, 2024.

How do you feel about the bitcoin mining activity in February? Please feel free to express your ideas and opinions in the space provided for comments below.