The stablecoin space has continued to grow this month, surpassing the $150 billion milestone on March 20, 2024, and receiving an additional $1.4 billion in funding since then. Ethena’s USDE led the group in supply growth for March, rising by 194.9% in the previous 30 days.

Leading Dollar-Pegged Token Values Rise in March as Major Players Change Positions

The stablecoin market has grown steadily each month this year as the cryptocurrency market is riding a bull run. This pattern is evident in the March figures, which show that the market for digital currencies backed by the US dollar grew from $143.3 billion to $151.4 billion. Even if the supply of some stablecoins decreased, the ecosystem’s overall market valuation increased by over $8 billion. This month, the supply of Tether (USDT), the industry leader in stablecoins, increased by 6.3%.

As of right now, Tether is valued at roughly $104.5 billion on the market. This month, Circle’s USDC saw a significant increase in supply, rising 13.1% to reach a market capitalization of $32.46 billion as of this writing. After its supply fell below 24 billion in mid-November 2023, USDC has essentially recovered to where it was a year earlier. A month ago, USDC had a $28.7 billion market capitalization. The supply of Makerdao’s DAI decreased by 1.7%, and it is currently worth about $4.9 billion.

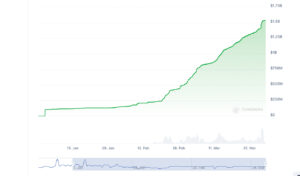

Growth in Ethena USDE’s market valuation during the previous ninety days.

Among the top five, First Digital’s FDUSD saw the biggest fall, losing 22.1% of its supply in the last month. After this drop, the market value of FDUSD is currently estimated to be around $2.56 billion. On the other hand, Ethena’s USDE had a significant increase in supply in March, increasing its market worth to $1.53 billion. This was a 194.9% increase in supply. This month, Tron’s USDD suffered a minor decline of 0.8%, bringing the coin’s market capitalization to roughly $732.4 million. The supply of Frax’s FRAX increased somewhat by 0.1%. March saw a sharp decline in the value of the Trueusd, with the supply of TUSD falling by 60.1% to $494 million.

The supply of TUSD has not been this low since April 2021, based on past records. Paypal’s PYUSD had a difficult March, falling 38.2% over the month, resulting in a market price of roughly $188.4 million. This past month, Alchemix’s ALUSD had a little 1.2% growth in supply, placing it just below PYUSD. ALUSD is currently valued at $166.6 million, making it the ninth largest stablecoin by market capitalization. Other stablecoins backed by the US dollar, like CRVUSD, USDP, and GUSD, also saw decreases, falling by approximately 4.2%, 28.9%, and 9.8%, respectively.

How do you feel about the expansion of the stablecoin economy in the last month? Please feel free to express your ideas and opinions in the space provided for comments below.