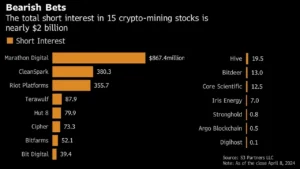

According to a recent study, the combined short interest in stocks of fifteen bitcoin mining businesses is getting close to $2 billion. About 663 blocks left until the next reward halving, which corresponds with a fall in the performance of these mining stocks from their earlier year stronger start.

Short Bets on Mining Stocks Are Triggered by the Upcoming Bitcoin Halving

The share value of well-known publicly traded bitcoin mining company Marathon Digital (Nasdaq: MARA) has dropped by more than 17% in the previous five days, and it has dropped by 19.7% during the last month. In a similar vein, Cleanspark (Nasdaq: CLSK) had a loss of 9.7% over the course of the month and an 11.7% decline during the course of the same five days. Similar to this, the majority of mining companies have recently underperformed, and the reward halving is in just five days.

The hashprice, or the expected daily value of 1 petahash per second (PH/s) of hashing power, has dropped from $119 just three days ago to $100 due to the current price slump. Miners’ earnings will be severely constrained by the next reward halving if the hashprice stays at this level. An increase in pricing might make matters worse. Short positions against 15 publicly traded mining corporations have increased due to the possibility of financial troubles for these companies.

According to information released by Bloomberg on Sunday, as of April 8, 2024, there is nearly to $2 billion in short interest in these mining companies, with a significant $867.4 million of that amount going toward Marathon Digital (MARA). Riot Platforms (RIOT) and Cleanspark (CLSK) are also major targets for short sellers. At least a dozen of these businesses have made large investments in tens of thousands of new mining equipment and facility expansions in advance of Bitcoin’s fourth reward reduction. Furthermore, as the half draws near, geopolitical concerns were not taken into account in any calculations.

Miners look to be facing a difficult situation as the fourth reward halving for Bitcoin approaches. More difficult times are likely, particularly for smaller operations and those with antiquated equipment, as evidenced by recent price declines from highs. Large mining companies that are publicly traded are also under pressure, as seen by sharp drops in stock prices. By substantially wagering against the stability of the sector, short sellers are speculating that these tendencies will continue.

How do you feel about short sellers going after bitcoin mining companies that are listed publicly? Please feel free to express your ideas and opinions in the space provided for comments below.